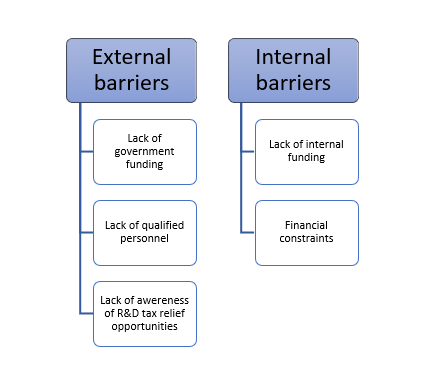

One of the aims of the Watson Project is to examine the effects of Research and Development tax relief on SMEs in Europe from the perspective of integral stakeholders such as accountants and/or consultants, universities/research centres, government agencies and SME representative organisations. The research focuses on organisations with a key role in either providing support for R&D grants and/or delivering R&D tax credit schemes, and representative bodies for small businesses which give a voice to SMEs in the respective member’s state. The Watson survey investigated the main barriers to innovation and to claiming R&D tax relief. In addition, the questionnaire explored suggestions and expectations to improve future R&D tax incentives and innovation policy in each respective participants’ country. Barriers to innovation are a crucial point to examine because they could slow down the success of innovation in Europe. Our preliminary analysis identified three external barriers and two internal barriers (see image below). Data was analysed using thematic and textual analysis.

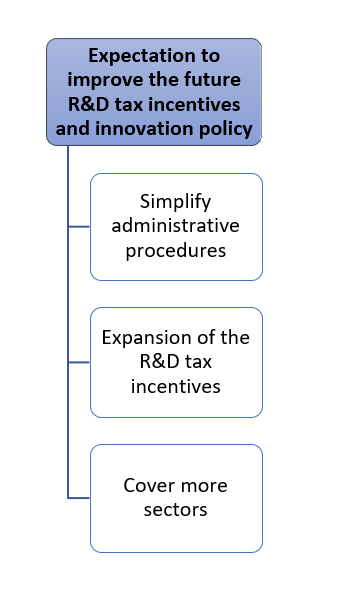

Data reveals that the main barrier to innovation is the lack of government funding. Results showed that 36% of participants declared that lack of government funding as the main barrier. An external barrier pointed out by participants is the lack of qualified personnel (20%) to be involved in R&D activities, along with lack of awareness (12%) regarding R&D tax incentives. In addition, the lack of private funding which could help SMEs to invest in R&D activities has been revealed. Foremost among the internal barriers identified is the lack of internal funding along with financial constraints. These last internal barriers could be a consequence of the credit crunch following the 2008 financial crisis and related austerity measures which effected SMEs more than large companies, especially in southern European countries (Wehinger, 2014). Regarding the expectations for the future R&D policy tax incentives, results of data analysed show that the future R&D policy should strive to simplifying the administrative procedures, to covering more sector and to expanding the R&D tax incentives scheme.